Pricing and charging are two terms that are often used interchangeably, but there is a subtle difference between the two. Pricing is the process of determining the value of a product or service, while charging is the act of collecting payment for that product or service.

Pricing is a strategic decision that should be made based on a number of factors, including the cost of production, the competitive landscape and the perceived value of the product or service.

Charging, on the other hand, is a more tactical decision that can be influenced by factors such as the customer’s willingness to pay, the terms of the sale, and the business’s overall pricing strategy.

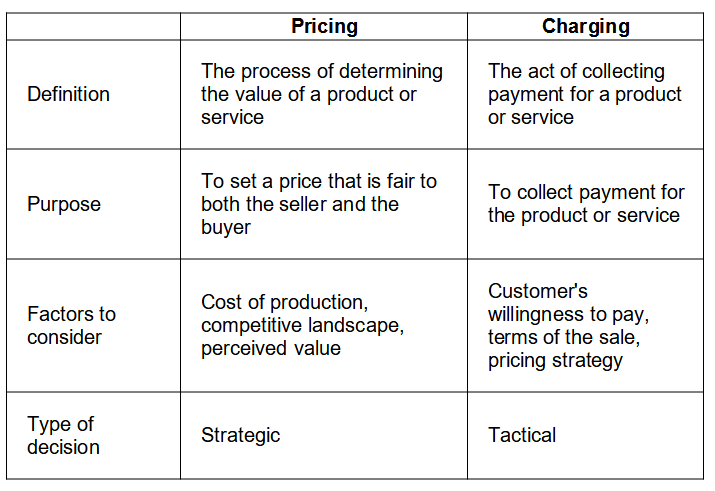

Here is a table that summarizes the key differences between pricing and charging:

Tectona Tip: Here we consider in, say, a football match, the strategy is the overall game plan and the tactics are the individual moves.

It is important to understand the difference between pricing and charging so that you can make sound business decisions.

Once a price has been set, the business can then decide how to charge for the product or service. This may involve offering discounts, setting up payment plans or charging different prices for different customers.

Here are some examples of how pricing and charging can be used in different business contexts:

- A business that sells furniture may use cost-plus pricing to determine the price of its products. This means that the business adds a markup to the cost of production to arrive at a selling price.

- A restaurant may use demand pricing to set its prices. This means that the restaurant charges more for its food during peak hours when demand is high. (This is also what Uber does with surge pricing during busy periods).

- A software company may offer a freemium pricing model. This means that the company offers a basic version of its software for free, and then charges for premium features or additional functionality.

The pricing and charging strategies that a business uses will vary depending on the industry, the product or service being offered and the business’ overall goals.

However, by understanding the difference between pricing and charging, businesses can make more informed decisions about how to set prices and collect payment for their products and services.

In addition to the factors mentioned in the table above, there are a few other things to keep in mind when pricing and charging your products and services. These include:

- The business’ target market: Who are its ideal customers? What are their needs and wants?

- The competitive landscape: What are the prices of similar products and services offered by competitors?

- The marketing and sales strategy: How will it promote and sell its products and services?

- The business’ financial goals: What is its desired profit margin?

Bearing all this in mind, businesses can develop a pricing and charging strategy that is both effective and profitable and, critically, right for them.

Having grasped the differences between Pricing and Charging, Tectona’s next article looks at the double edged sword of discounting.

And how to charge (or discount) successfully.

About Tectona

Tectona Partnership helps business owners sleep at night by embedding one of our 17 commercially minded finance directors in your management team.

Very often, a part time finance director is the most effective solution.

We make sure you have the necessary management information and strategic insight to make informed decisions and reduce risk; and we will absolutely tell you what you need to know, when you need to know it.