Context

If you are claiming R&D tax relief, it’s important to understand the correspondence you might receive from HMRC and what to do next. Up to now, most applications for R&D relief result in money hitting your bank account, with little or no direct communication between you and HMRC. But times have changed.

HMRC has recently changed its approach to R&D claims in an attempt to prevent misuse.

In 2020, the tax authority added 100 new R&D staff to its compliance unit. This expansion will inevitably lead to more companies facing enquiries and, in turn, receiving compliance check letters.

Leading R&D tax specialist, ForrestBrown, recently become aware of software companies receiving R&D ‘eligibility’ letters from HMRC. These so-called ‘nudge’ letters encourage companies to re-examine their R&D claims to identify and come clean on errors.

In this article we address these 3 issues:

- What do these HMRC R&D letters look like?

- What are they actually asking for?

- And, most importantly, what do you need to do about them?

Deciphering correspondence from HMRC isn’t always simple (after all they refer to us taxpayers as their ‘customers’!), so we’ll look at some of the types of correspondence you might receive and some of the common jargon you may find.

There are 2 broad types of letter:

- HMRC R&D eligibility letter; and

- HMRC enquiry letter

In this article we look at the first of these – the R&D eligibility letter.

HMRC R&D eligibility letter

You might receive a letter from HMRC which is known in the tax world as a ‘nudge’ letter. This is not a compliance check or ‘enquiry’ letter (see our separate article on that here), however that does not mean it can simply be filed and ignored.

So, In 3:

-

What is an R&D eligibility letter and how do I identify it?

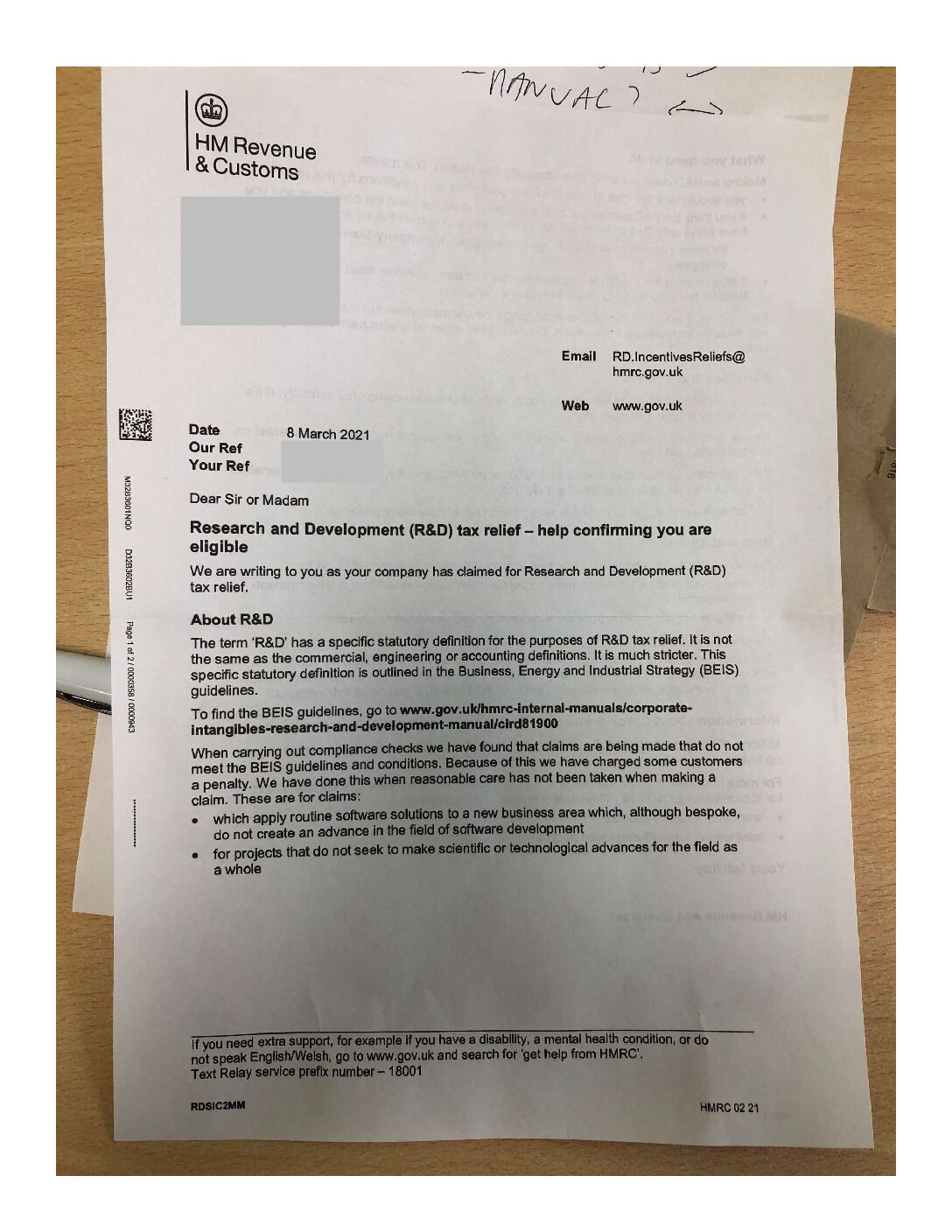

Eligibility letters, also known as ‘nudge’ letters, are typically used by HMRC as a proactive way to get companies to address potential errors in their R&D claims. These nudge letters are likely to contain the phrase: “help confirming you are eligible”.

Receiving an R&D eligibility letter like this does not necessarily mean anything is wrong with your R&D claim. But it should absolutely be taken as an opportunity for you to check that you are fully confident that your claim would withstand a compliance check.

You need to be able to correctly identify an eligibility letter. These letters tend to follow a template.

You can expect to see the heading: “Research and Development (R&D) tax relief – help confirming you are eligible”. This is the most obvious indicator.

Another phrase to look out for is: “if you think the R&D carried out by the company does not meet the conditions, you should also make sure you report this accurately when filing your next Company Tax return.” These letters refer to the BEIS guidelines and include web links to relevant gov.uk pages too.

-

Why have I received a ‘nudge’ letter?

Receiving a ‘nudge’ letter does not necessarily mean anything is wrong with your R&D claim. These eligibility check letters are another mechanism for encouraging businesses and their advisers to scrutinise R&D claims and avoid errors.

Tectona tip: The background here is that HMRC are under pressure from the National Audit Office to reduce the number of errors in R&D claims that have been uncovered during compliance checks – and last year their R&D team received a boost with 100 new team members.

HMRC still only have the resources to review in detail a small proportion of the R&D claims filed each year. By sending out these advisory letters they hope to encourage companies to look at HMRC’s own guidance on R&D claims. The aim is that companies will review their own claims without the need for an enquiry.

-

What do I need to do?

What you need to do next really depends on whether you have prepared your claim yourself or used an adviser to help you.

- I prepared the R&D claim myself – in the correspondence you will see some links to HMRC’s guidance on R&D claims – these resources can be very useful. Ideally, you will have used these to prepare your claim. If you are not already familiar with them, then you have got some reading to do!

If you don’t have time or are still uncertain, you can reach out to an expert like ForrestBrown who will be happy to review your R&D claim and provide you with clear written advice explaining any risks and making practical recommendations for next steps.

If your claim does need to be amended to address any errors, an R&D tax adviser will know how to do this as efficiently as possible. Your accountant will typically be very happy to help you as well, although they may recommend bringing in a specialist; they may even have one that they recommend.

- I worked with an R&D tax adviser to prepare my R&D claim – you should share the letter with them as soon as you receive it. They should be very happy to advise you and answer any questions you have.

We don’t recommend settling for a general reassurance that everything is fine.

Remember that you carry the risk associated with your R&D claim – not your adviser. It is therefore your adviser’s role to ensure you fully understand your claim and any risks within it. If you don’t, then you must ask questions. And if you are not satisfied with their handling of your questions, seek a second opinion. Do not wait until you receive a compliance check letter or you will have missed the opportunity to address any errors with minimal fuss.

In a nutshell, this is ForrestBrown’s advice:

- Take any HMRC letter about your R&D claim seriously.

- Payment doesn’t equal approval – just because you’ve received cash doesn’t mean that HMRC has approved your R&D claim. They have processed it, but they may be back to check that you have got your claim right.

- R&D tax advice is a (largely) unregulated market and one that has attracted spurious advisers. So you need to be sure you are working with the right people who will readily support you in the event of an enquiry.

Again, remember that you carry the risk associated with your R&D claim – not your adviser, not your accountant.

Act now

ForrestBrown will customise their service to match your requirements. They are highly experienced in software R&D claims and liaising with HMRC and can review your claim and support you with specific expertise on a consultancy basis. Contact ForrestBrown.

Tectona Tip: This is a specialist area and, if you want to minimise the risk to your business, you must speak to the right people. We see it as so critical that the Tectona team will no longer prepare and submit R&D tax claims on behalf of businesses. Quite simply, we recognise that we do not have the depth of experience of the likes of ForrestBrown – so Tectona refer all such claims to the experts.

About Tectona

Tectona Partnership helps business owners sleep at night by embedding one of our 16 commercially minded finance directors in your management team. Very often, a part time solution is the most effective solution for small businesses.

We make sure you have the necessary management information and strategic insight to make informed decisions and we will absolutely tell you what you need to know when you need to know it.