If you are claiming (or have claimed) R&D tax relief, it’s important to understand the correspondence you might receive from HMRC and what to do next. Up to now, most applications for R&D relief result in money hitting your bank account, with little or no direct communication between you and HMRC. But times have changed.

Tectona Tip: Remember that it is YOU that carries the risk associated with your R&D claim; not your adviser, not your accountant.

HMRC has recently changed its approach to R&D claims in an attempt to clamp down on abuse.

You should also know that in 2020, HMRC added 100 new R&D staff to its compliance unit. This expansion, coupled with their considerably broadened powers, will inevitably lead to more companies facing enquiries and, in turn, receiving compliance check letters.

Deciphering correspondence from HMRC isn’t always simple, so we’ll look at some of the types of correspondence you might receive and some of the common jargon you’ll find.

There are 2 broad types of letters you might receive:

- HMRC R&D eligibility letter; and

- HMRC enquiry or compliance letter

We look at the eligibility letter in a separate article.

HMRC R&D compliance letter

When you submit an R&D tax relief claim to HMRC it should be quickly processed by HMRC. In most cases, a simple desktop review of your claim documents will be sufficient for HMRC to process your claim. On occasion, HMRC will ask for more information to clarify any questions they might have. This process is known as an enquiry.

If you’ve received a letter from HMRC saying that they are conducting a compliance check into your R&D tax credit claim, this is the start of the ‘enquiry’. With an increased scrutiny on R&D claims from HMRC, these compliance check letters are going to be increasingly common.

It is vitally important that you take them seriously, and act quickly.

An R&D tax relief compliance letter is HMRC’s way of communicating with you that they need more information to clarify questions about your R&D claim.

It is important to remember that compliance checks look at your company tax return, so they can be very broad in scope. The opening letter will tell you what HMRC are looking into – and if it is your R&D claim, it will say just that.

So, in 3:

-

Identifying a compliance check letter

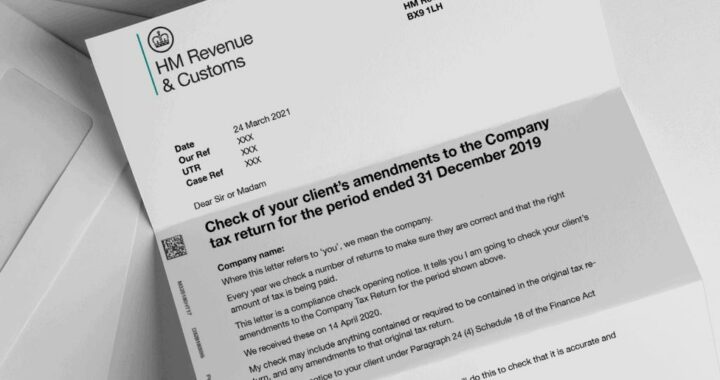

The letter will explain that it is a compliance check opening notice. In the same way HMRC usually refers to taxpayers as ‘customers’, an enquiry letter rarely includes the word ‘enquiry’ in it. Instead, you will receive a letter with this sort of words in bold:

“Check of the Company tax return for the period ended…”

The correspondence will also include some legislative references and probably some attachments. A number of factsheets will be included to help you understand your situation and how to correspond with HMRC. A common factsheet to be included is the CC/FS1a ‘About compliance’ checks. These factsheets can add bulk and an opening letter can run to nine or ten pages, but usually only one of these contains questions you need to answer. The rest will be background information and guidance.

-

Why have I received a compliance check letter?

HMRC will open enquiries into a proportion of all R&D tax credit claims. Due to a shift in approach, this proportion has increased. The reasons why HMRC might open an enquiry vary. It might be related to your company and its status or about the nature of your R&D work.

The following are some of the more common reasons behind HMRC sending you a compliance letter:

- HMRC believe they have found an inconsistency – an aspect or detail that they do not find credible in your claim. This will be highlighted in their opening letter.

- HMRC are fact-finding following a change in your circumstances, such as an increased claim value.

- HMRC have questions about your tax return – which, although unrelated to R&D – has triggered the enquiry. R&D is usually then included for completeness.

- HMRC are focusing enquiries on a particular sector or type of technology to ensure they are approaching claims in the sector consistently.

-

What you need to do

The letter is the start of an HMRC enquiry and the most important thing at this point is to treat the matter with urgency. It can be tempting to delay putting a plan in place around your response. Sometimes the importance of the letter, the actions you need to take and the deadline itself can be lost in the many pages of jargon and guidance.

In short, if you are facing an enquiry, do not ignore it. You will typically have 30 days to respond to the questions or requests in the letter, but make sure you check the date as the letter will have taken a few days to reach you if it has come by post. If this feels like a long time, it isn’t! It is critical that your first response is timely and thorough; so avoid a last minute rush.

If you have worked with an R&D tax adviser to prepare your R&D claim, then share the letter with them immediately. They should quickly provide you with a plan for how they will manage the response. As with the nudge letters, if you are worried, you can seek a second opinion at this point.

Compliance checks can end in penalties if errors are found in your claim. How much will depend on how you have behaved during the enquiry. Missed deadlines or lapses in communication will count against you.

If you have concerns about your adviser or want expert support get in touch with Tectona and we will signpost you to the right expert.

Enquiry support teams are usually made up of:

- former HMRC inspectors

- qualified chartered tax advisers and accountants

- sector specialists and

- lawyers.

Tectona Tip: Do not mess about – you need this depth of experience on your side.

Once instructed, they will step in to resolve the enquiry on your behalf, achieving the best possible result for your business. (They offer SME or RDEC enquiry defence, or both, allowing you to focus on running your business).

Here is the advice from one expert in a nutshell:

- Take any HMRC letter about your R&D claim very seriously.

- Payment doesn’t equal approval – just because you’ve received cash doesn’t mean that HMRC has approved your R&D claim. They have processed it, but they may be back to check that you’ve got your claim right.

- R&D tax advice is a (largely) unregulated market and one that has attracted spurious advisers. So you need to be sure you are working with the right people who will readily support you in the event of an enquiry.

- Remember that you carry the risk associated with your R&D claim, not your adviser or accountant.

Most businesses are well-intentioned and set out to pay the right amount of tax and maintain a good working relationship with HMRC. But they have often fallen victim to spurious marketing claims and poor tax advice which has led them into a potentially difficult situation.

These businesses only became aware of problems with their claims once they were in a formal compliance check, and unpicking these issues takes time.

If you have received correspondence from HMRC in relation to your R&D tax claim, it is important not to panic and not to ignore it. You should however act quickly and decisively.

We will introduce you to someone who will review your claim and offer the support you need on a consultancy basis.

Tectona Tip: This is a specialist area and, if you want to minimise the risk to your business, you must speak to the right people.

We see it as so critical that the Tectona team will no longer prepare and submit R&D tax claims on behalf of businesses. Quite simply, we recognise that we do not have the depth of experience of the industry experts – so Tectona refer all such claims to the experts.

About Tectona

Tectona Partnership helps business owners sleep at night by embedding one of our 16 commercially minded finance directors in your management team. Very often, a part time solution is the most effective solution.

We make sure you have the necessary management information and strategic insight to make informed decisions and we will absolutely tell you what you need to know, when you need to know it.